While the broader market has struggled with the S&P 500 down 1% since November 2024, Domino's has surged ahead as its stock price has climbed by 11.9% to $488 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Domino's, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Domino's Not Exciting?

We’re happy investors have made money, but we don't have much confidence in Domino's. Here are three reasons why there are better opportunities than DPZ and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

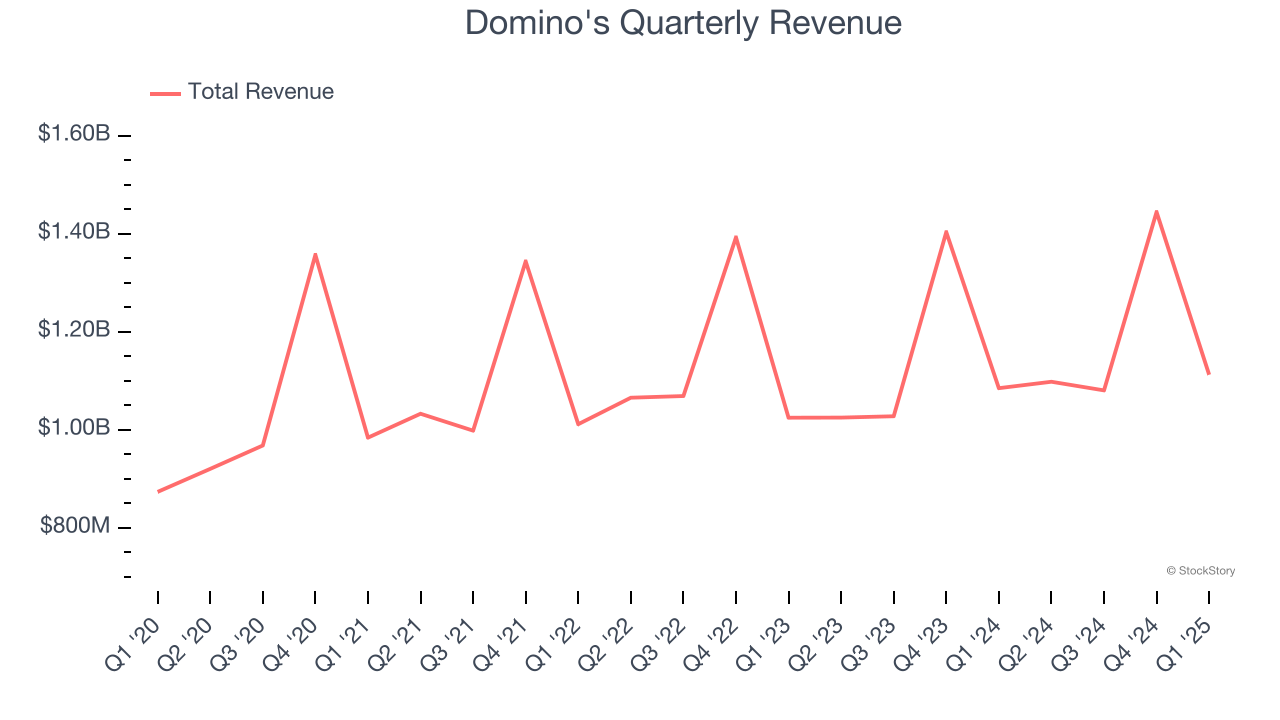

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last six years, Domino's grew its sales at a tepid 5.2% compounded annual growth rate. This fell short of our benchmark for the restaurant sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Domino’s revenue to rise by 5.7%, close to its 5.2% annualized growth for the past six years. This projection doesn't excite us and implies its newer menu offerings will not lead to better top-line performance yet.

3. Operating Margin in Limbo

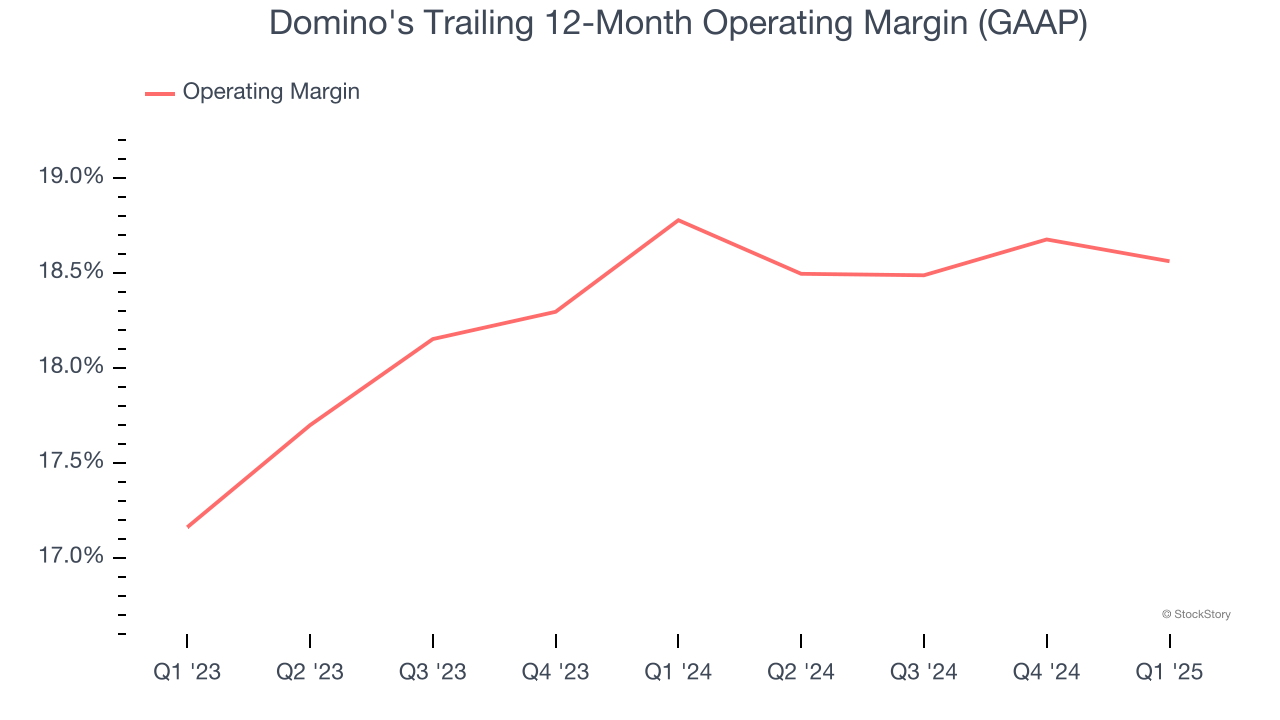

Operating margin is a key profitability metric because it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

Looking at the trend in its profitability, Domino’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 18.6%.

Final Judgment

Domino's isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at 27.2× forward P/E (or $488 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. We’d suggest looking at one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.