Over the past six months, Shake Shack’s shares (currently trading at $113.58) have posted a disappointing 8.5% loss while the S&P 500 was down 1%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Shake Shack, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Shake Shack Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than SHAK and a stock we'd rather own.

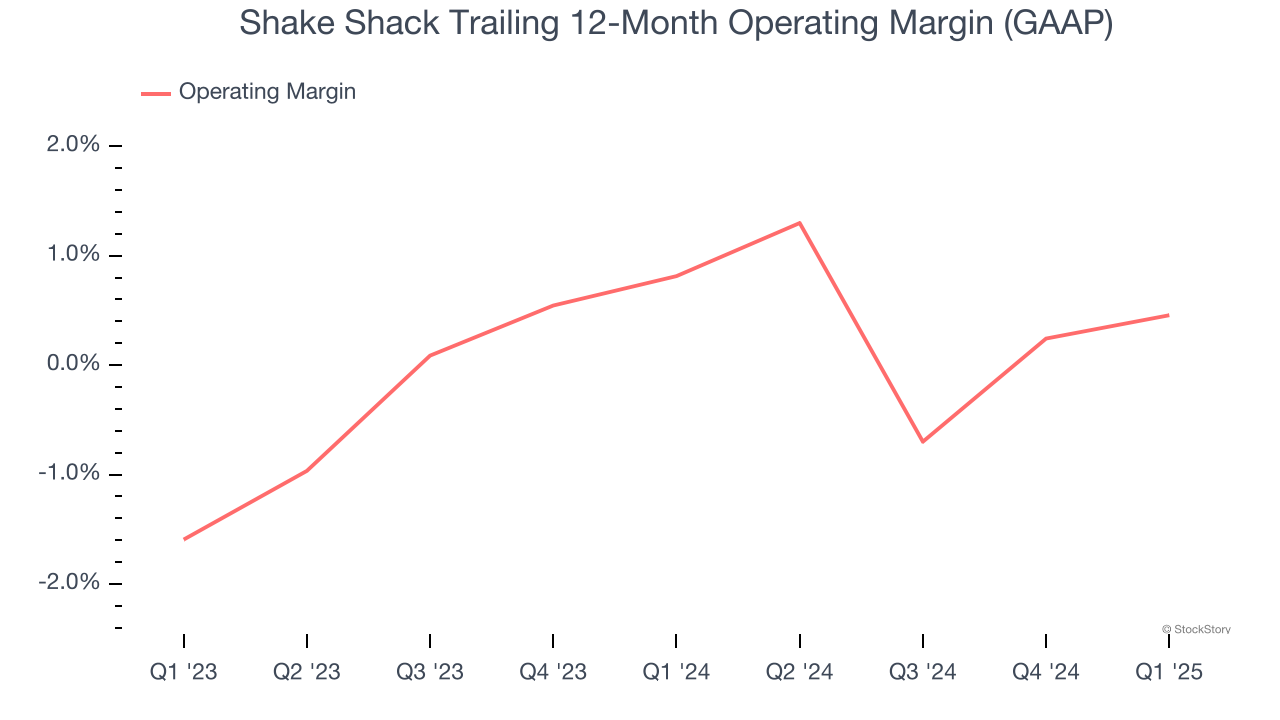

1. Breakeven Operating Raises Questions

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Shake Shack was roughly breakeven when averaging the last two years of quarterly operating profits, inadequate for a restaurant business. This result is surprising given its high gross margin as a starting point.

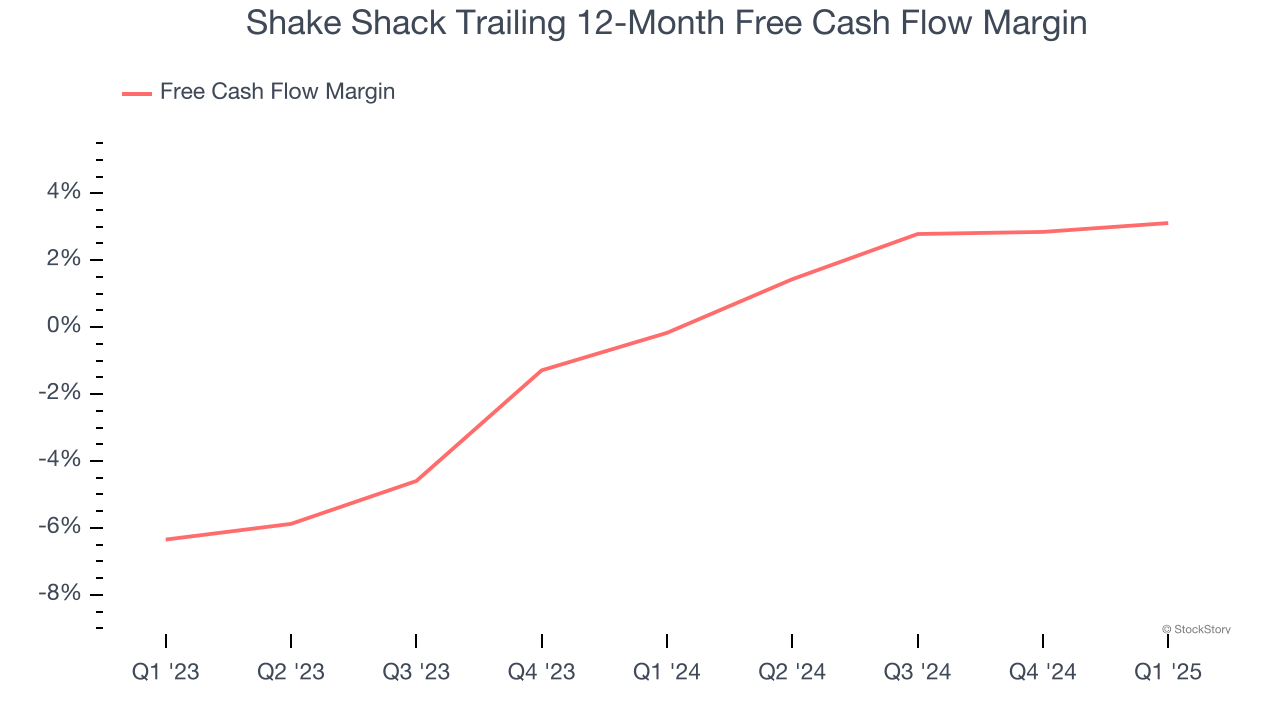

2. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Shake Shack has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.6%, subpar for a restaurant business.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Shake Shack’s five-year average ROIC was negative 3.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

Final Judgment

Shake Shack’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 85.7× forward P/E (or $113.58 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Shake Shack

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.