Let’s dig into the relative performance of United Rentals (NYSE:URI) and its peers as we unravel the now-completed Q1 specialty equipment distributors earnings season.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 9 specialty equipment distributors stocks we track reported a satisfactory Q1. As a group, revenues missed analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

Luckily, specialty equipment distributors stocks have performed well with share prices up 12.1% on average since the latest earnings results.

United Rentals (NYSE:URI)

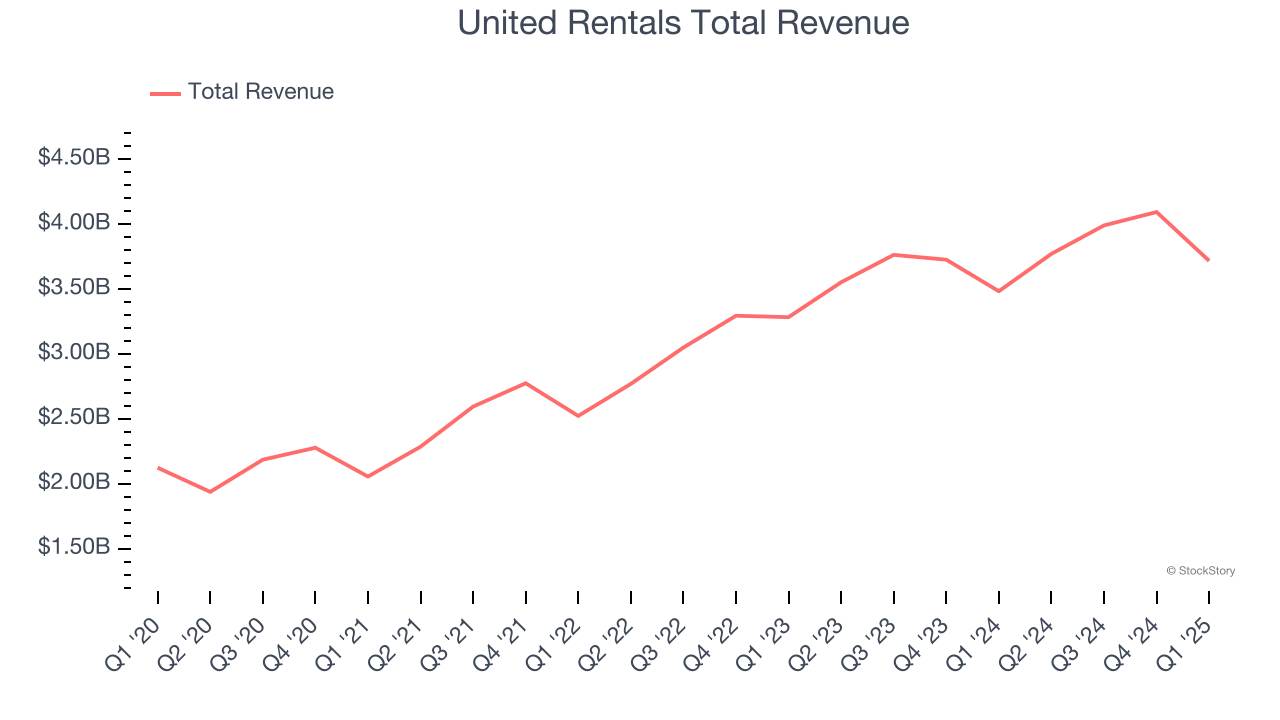

Owning the largest rental fleet in the world, United Rentals (NYSE:URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

United Rentals reported revenues of $3.72 billion, up 6.7% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ organic revenue and EBITDA estimates.

Matthew Flannery, chief executive officer of United Rentals, said, “2025 is off to a solid start, reflecting demand across both our construction and industrial end-markets. I’m pleased with the team’s commitment to putting our customers first, which ultimately translated to record first-quarter revenue and adjusted EBITDA. I’m also pleased to reaffirm our full-year guidance, based on both the momentum we’re carrying into our busy season and continued positive customer sentiment, which, together, reinforce our expectations for another year of profitable growth.”

Interestingly, the stock is up 20.7% since reporting and currently trades at $710.

Best Q1: Hudson Technologies (NASDAQ:HDSN)

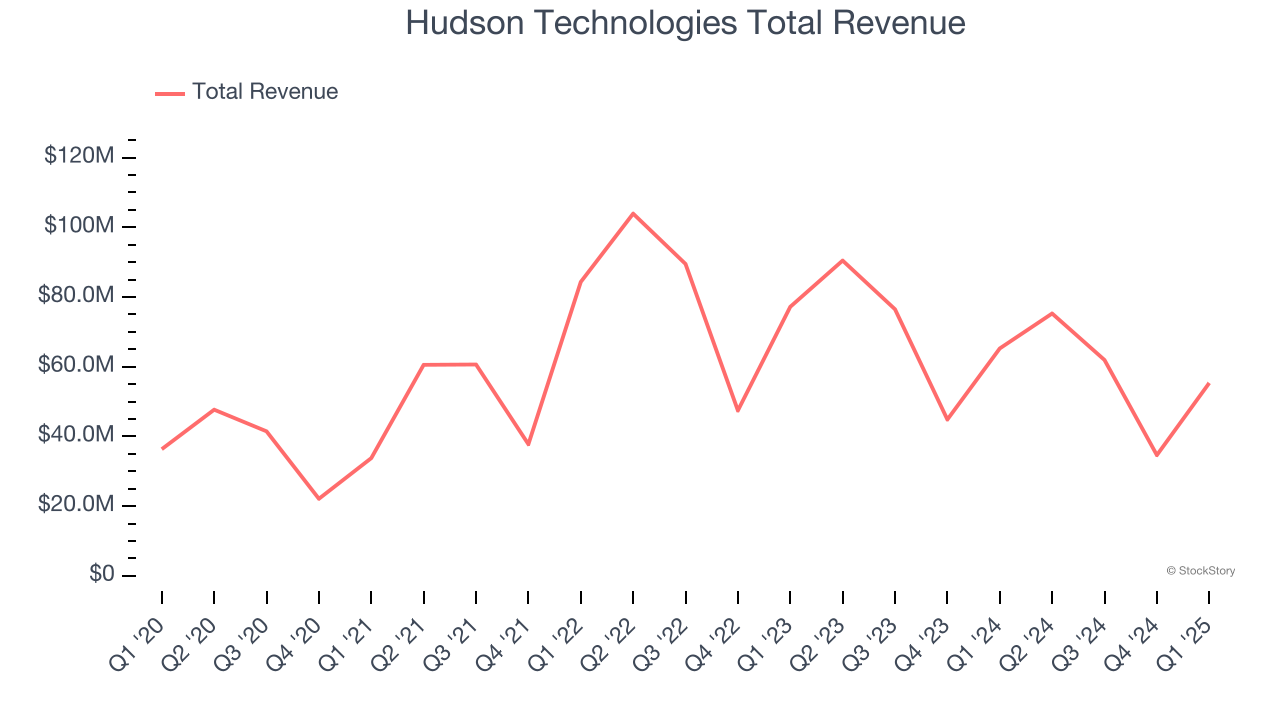

Founded in 1991, Hudson Technologies (NASDAQ:HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $55.34 million, down 15.2% year on year, outperforming analysts’ expectations by 6%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Hudson Technologies scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 13.1% since reporting. It currently trades at $7.59.

Is now the time to buy Hudson Technologies? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: H&E Equipment Services (NASDAQ:HEES)

Founded after recognizing a growth trend along the Mississippi River and opportunities developing in the earthmoving and construction equipment business, H&E (NASDAQ:HEES) offers machinery for companies to purchase or rent.

H&E Equipment Services reported revenues of $319.5 million, down 14% year on year, falling short of analysts’ expectations by 11.9%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

H&E Equipment Services delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 4.9% since the results and currently trades at $94.75.

Read our full analysis of H&E Equipment Services’s results here.

Alta (NYSE:ALTG)

Founded in 1984, Alta Equipment Group (NYSE:ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Alta reported revenues of $423 million, down 4.2% year on year. This number came in 2.3% below analysts' expectations. More broadly, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EBITDA estimates but a miss of analysts’ EPS estimates.

The stock is up 20.5% since reporting and currently trades at $5.46.

Read our full, actionable report on Alta here, it’s free.

Richardson Electronics (NASDAQ:RELL)

Founded in 1947, Richardson Electronics (NASDAQ:RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Richardson Electronics reported revenues of $53.8 million, up 2.7% year on year. This print missed analysts’ expectations by 1.7%. Zooming out, it was actually a strong quarter as it recorded an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The stock is down 6.9% since reporting and currently trades at $9.11.

Read our full, actionable report on Richardson Electronics here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.