As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the home furnishing and improvement retail industry, including Lowe's (NYSE:LOW) and its peers.

Home furnishing and improvement retailers understand that ‘home is where the heart is’ but that a home is only right when it’s in livable condition and furnished just right. These stores therefore focus on providing what is needed for both the upkeep of a house as well as what is desired for the aesthetics of a home. Decades ago, it was thought that furniture and home improvement would resist e-commerce because of the logistical challenges of shipping a sofa or lawn mower, but now you can buy both online; so just like other retailers, these stores need to adapt to new realities and consumer behaviors.

The 7 home furnishing and improvement retail stocks we track reported a slower Q1. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

While some home furnishing and improvement retail stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.2% since the latest earnings results.

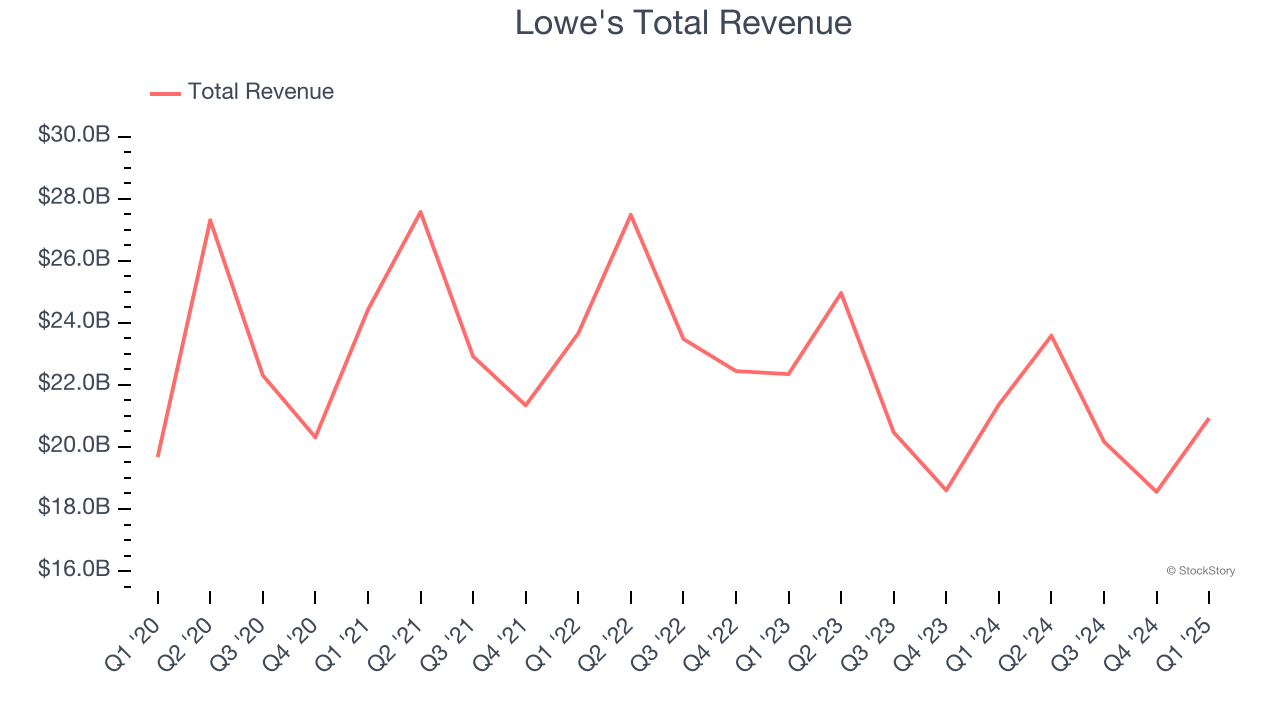

Lowe's (NYSE:LOW)

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

Lowe's reported revenues of $20.93 billion, down 2% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a narrow beat of analysts’ gross margin estimates but full-year revenue guidance meeting analysts’ expectations.

"Despite near-term uncertainty and housing market headwinds, our team's unwavering focus on exceptional customer service has elevated satisfaction scores and earned Lowe's the #1 ranking in Customer Satisfaction among Home Improvement Retailers* by J.D. Power," said Marvin R. Ellison, Lowe's chairman, president and CEO.

Lowe's pulled off the highest full-year guidance raise of the whole group. Still, the market seems discontent with the results. The stock is down 9.3% since reporting and currently trades at $217.90.

Is now the time to buy Lowe's? Access our full analysis of the earnings results here, it’s free.

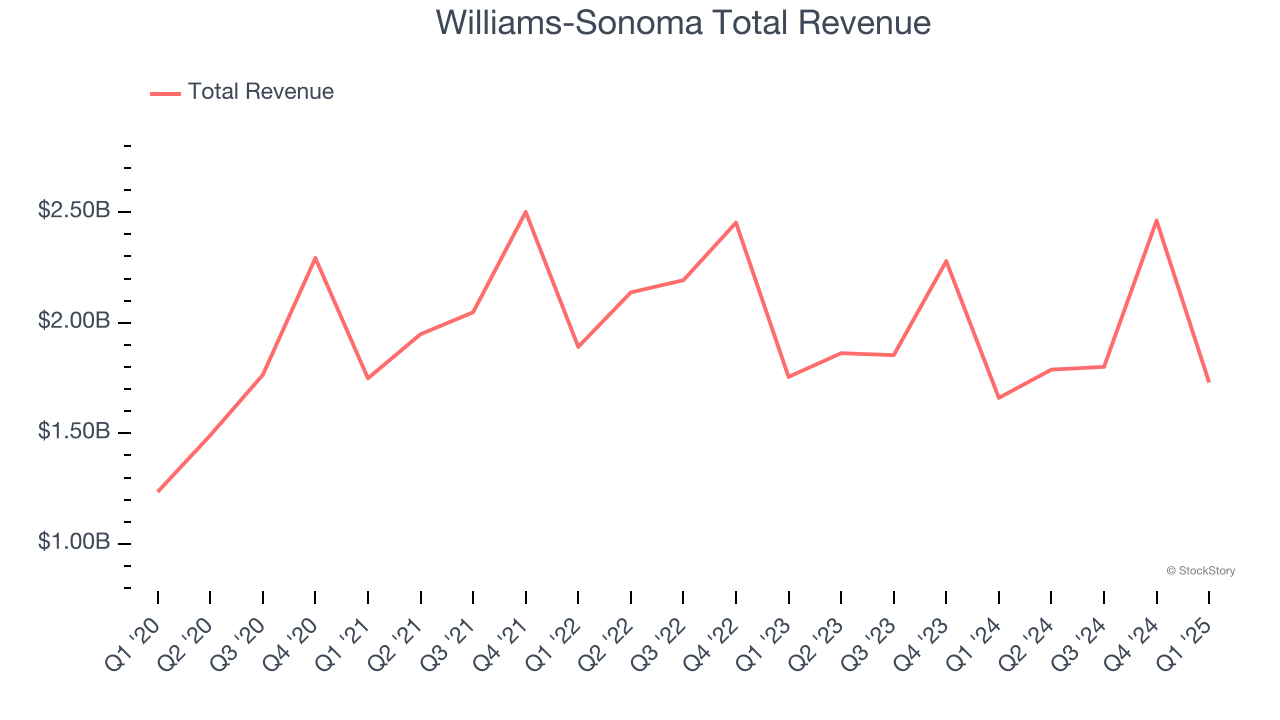

Best Q1: Williams-Sonoma (NYSE:WSM)

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

Williams-Sonoma reported revenues of $1.73 billion, up 4.2% year on year, outperforming analysts’ expectations by 4%. The business had a strong quarter with a decent beat of analysts’ EBITDA estimates.

Williams-Sonoma pulled off the biggest analyst estimates beat among its peers. The stock is down 9.3% since reporting. It currently trades at $152.13.

Is now the time to buy Williams-Sonoma? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Sleep Number (NASDAQ:SNBR)

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Sleep Number reported revenues of $393.3 million, down 16.4% year on year, falling short of analysts’ expectations by 1.2%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Sleep Number delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 6.7% since the results and currently trades at $7.27.

Read our full analysis of Sleep Number’s results here.

Floor And Decor (NYSE:FND)

Operating large, warehouse-style stores, Floor & Decor (NYSE:FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

Floor And Decor reported revenues of $1.16 billion, up 5.8% year on year. This number was in line with analysts’ expectations. Aside from that, it was a slower quarter as it produced full-year revenue guidance missing analysts’ expectations.

The stock is up 1.8% since reporting and currently trades at $73.63.

Read our full, actionable report on Floor And Decor here, it’s free.

Home Depot (NYSE:HD)

Founded and headquartered in Atlanta, Georgia, Home Depot (NYSE:HD) is a home improvement retailer that sells everything from tools to building materials to appliances.

Home Depot reported revenues of $39.86 billion, up 9.4% year on year. This result surpassed analysts’ expectations by 1.6%. More broadly, it was a slower quarter as it logged a miss of analysts’ EBITDA estimates and gross margin in line with analysts’ estimates.

The stock is down 6.4% since reporting and currently trades at $354.95.

Read our full, actionable report on Home Depot here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.