Casual restaurant chain Brinker International (NYSE:EAT) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 21% year on year to $1.46 billion. The company expects the full year’s revenue to be around $5.65 billion, close to analysts’ estimates. Its non-GAAP profit of $2.49 per share was 0.8% above analysts’ consensus estimates.

Is now the time to buy Brinker International? Find out by accessing our full research report, it’s free.

Brinker International (EAT) Q2 CY2025 Highlights:

- Revenue: $1.46 billion vs analyst estimates of $1.44 billion (21% year-on-year growth, 1.6% beat)

- Adjusted EPS: $2.49 vs analyst estimates of $2.47 (0.8% beat)

- Adjusted EBITDA: $212.4 million vs analyst estimates of $208.9 million (14.5% margin, 1.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $10.20 at the midpoint, beating analyst estimates by 2.9%

- Operating Margin: 9.8%, up from 6.1% in the same quarter last year

- Free Cash Flow Margin: 7.3%, similar to the same quarter last year

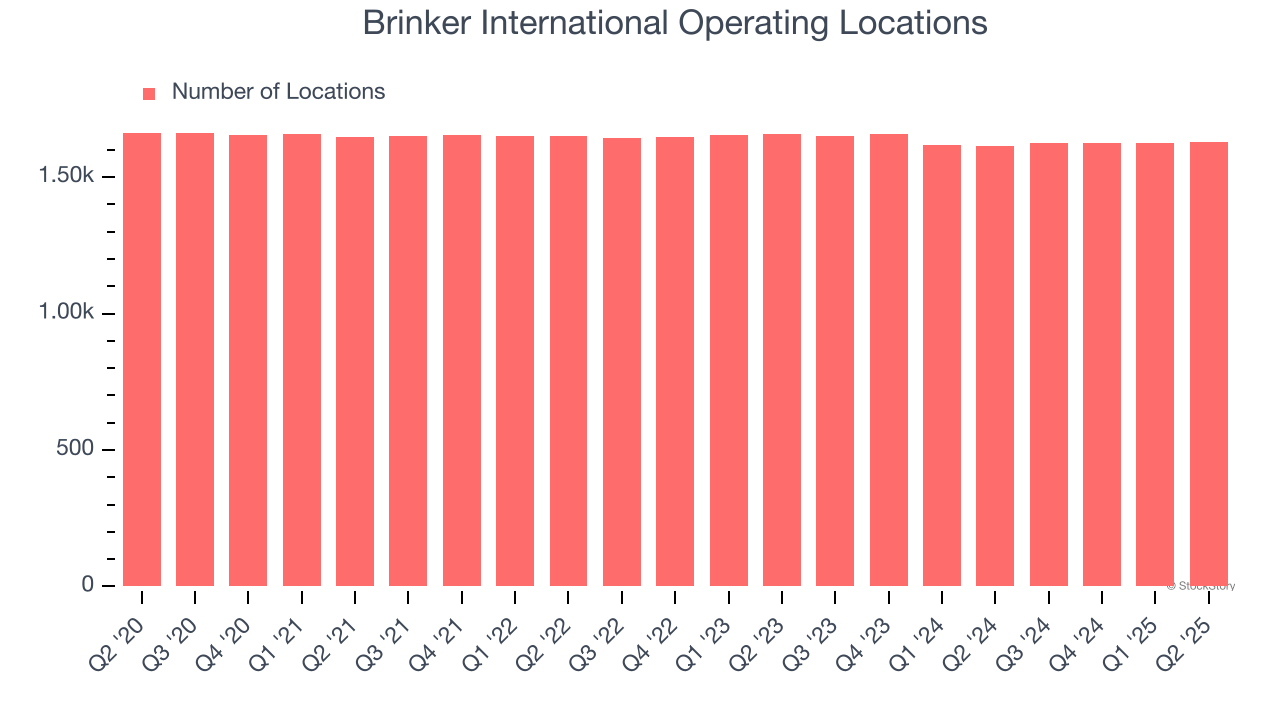

- Locations: 1,628 at quarter end, up from 1,614 in the same quarter last year

- Same-Store Sales rose 19.8% year on year (11.9% in the same quarter last year)

- Market Capitalization: $6.88 billion

"Chili's delivered another strong quarter with sales +24% driven by traffic of +16%," said Kevin Hochman, President & CEO of Brinker International, "We now have delivered a Q4 2 year sales growth of +39% and 3-year of +45%.

Company Overview

Founded by Norman Brinker in Dallas, Brinker International (NYSE:EAT) is a casual restaurant chain that operates the Chili’s, Maggiano’s Little Italy, and It’s Just Wings banners.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $5.38 billion in revenue over the past 12 months, Brinker International is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions.

As you can see below, Brinker International grew its sales at a decent 9% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) despite not opening many new restaurants, implying that growth was driven by higher sales at existing, established dining locations.

This quarter, Brinker International reported robust year-on-year revenue growth of 21%, and its $1.46 billion of revenue topped Wall Street estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and suggests its menu offerings will face some demand challenges. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

Number of Restaurants

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Brinker International operated 1,628 locations in the latest quarter, and over the last two years, has kept its restaurant count flat while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

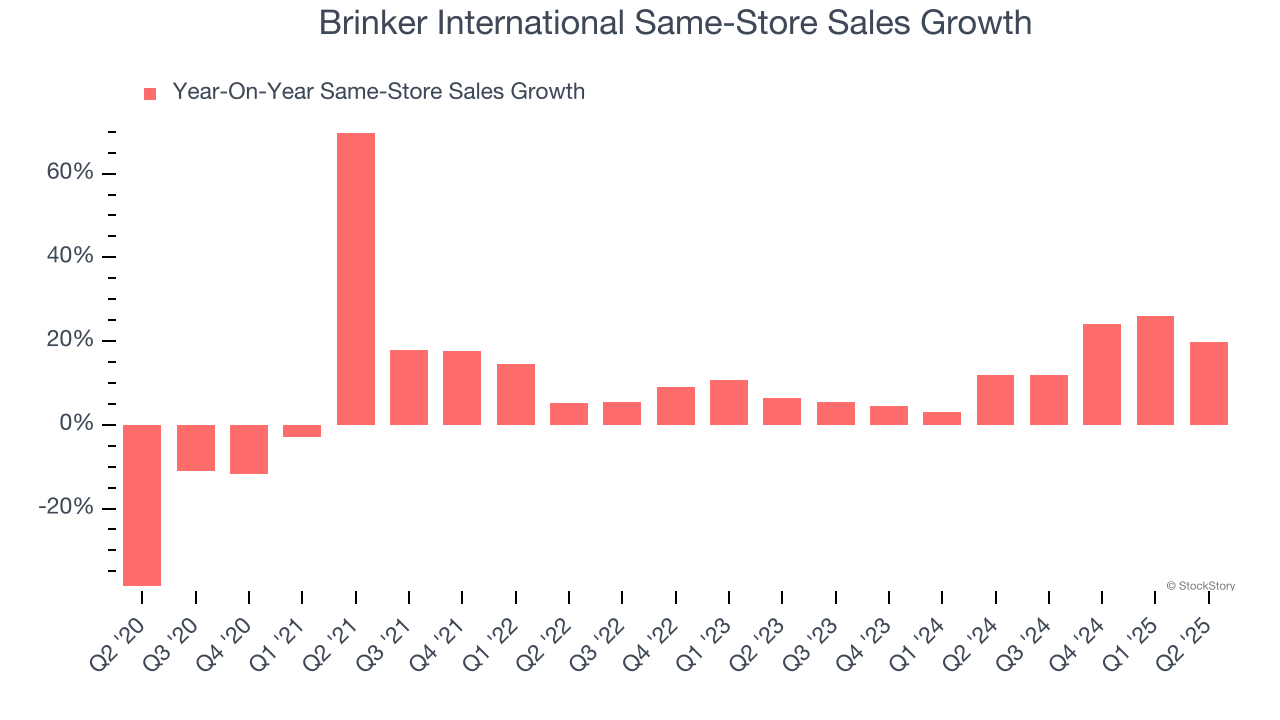

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Brinker International has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 13.3%. Given its flat restaurant base over the same period, this performance stems from a mixture of higher prices and increased foot traffic at existing locations.

In the latest quarter, Brinker International’s same-store sales rose 19.8% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Brinker International’s Q2 Results

We were impressed by how significantly Brinker International blew past analysts’ same-store sales expectations this quarter. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. Investors were likely hoping for more, and shares traded down 4.3% to $148.39 immediately following the results.

So do we think Brinker International is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.