3D printing company Stratasys (NASDAQ:SSYS) reported Q2 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $138.1 million. On the other hand, the company’s full-year revenue guidance of $555 million at the midpoint came in 3.1% below analysts’ estimates. Its non-GAAP profit of $0.03 per share was in line with analysts’ consensus estimates.

Is now the time to buy Stratasys? Find out by accessing our full research report, it’s free.

Stratasys (SSYS) Q2 CY2025 Highlights:

- Revenue: $138.1 million vs analyst estimates of $137.2 million (flat year on year, 0.7% beat)

- Adjusted EPS: $0.03 vs analyst estimates of $0.03 (in line)

- Adjusted EBITDA: $6.13 million vs analyst estimates of $6.74 million (4.4% margin, 9.1% miss)

- The company dropped its revenue guidance for the full year to $555 million at the midpoint from $577.5 million, a 3.9% decrease

- Management lowered its full-year Adjusted EPS guidance to $0.15 at the midpoint, a 56.7% decrease

- EBITDA guidance for the full year is $31 million at the midpoint, below analyst estimates of $44.58 million

- Operating Margin: -12%, up from -18.9% in the same quarter last year

- Market Capitalization: $965.6 million

“Our results once again reflect resilience from our recurring revenue streams and the reliance customers place on our additive manufacturing technologies," commented Dr. Yoav Zeif, Stratasys' Chief Executive Officer.

Company Overview

Born from the Founder’s idea of making a toy frog with a glue gun, Stratasys (NASDAQ:SSYS) offers 3D printers and related materials, software, and services to many industries.

Revenue Growth

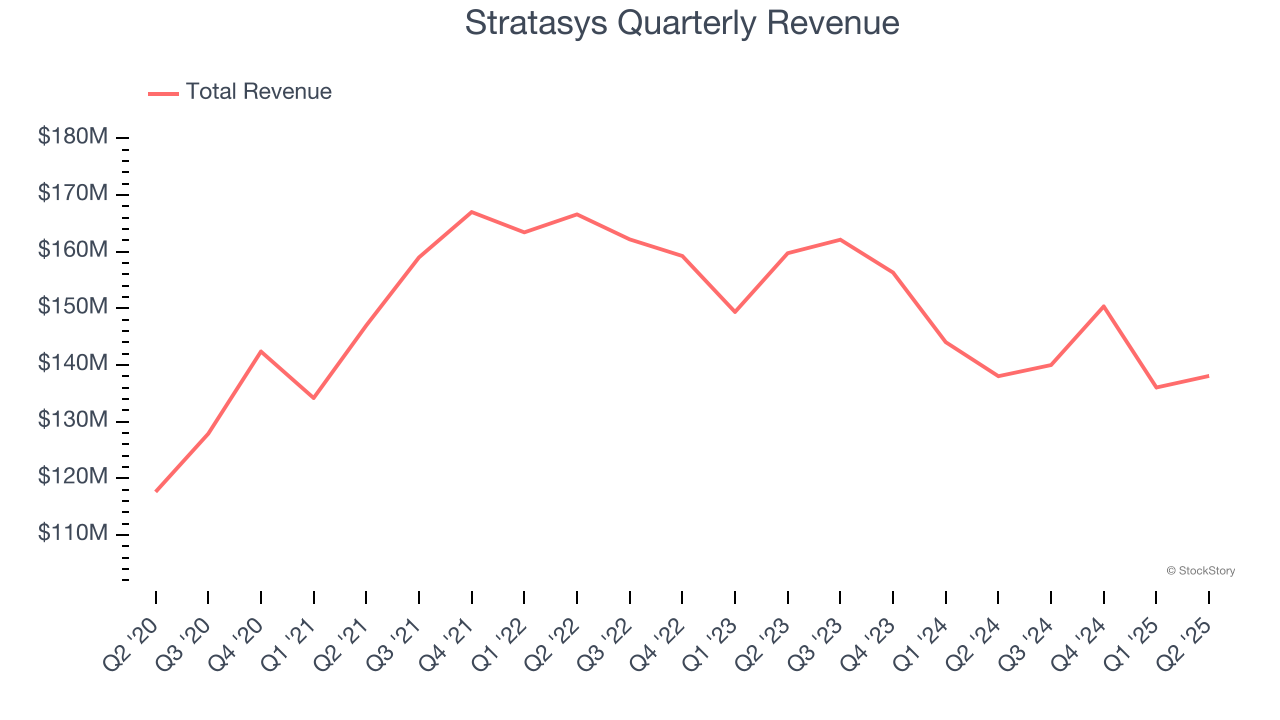

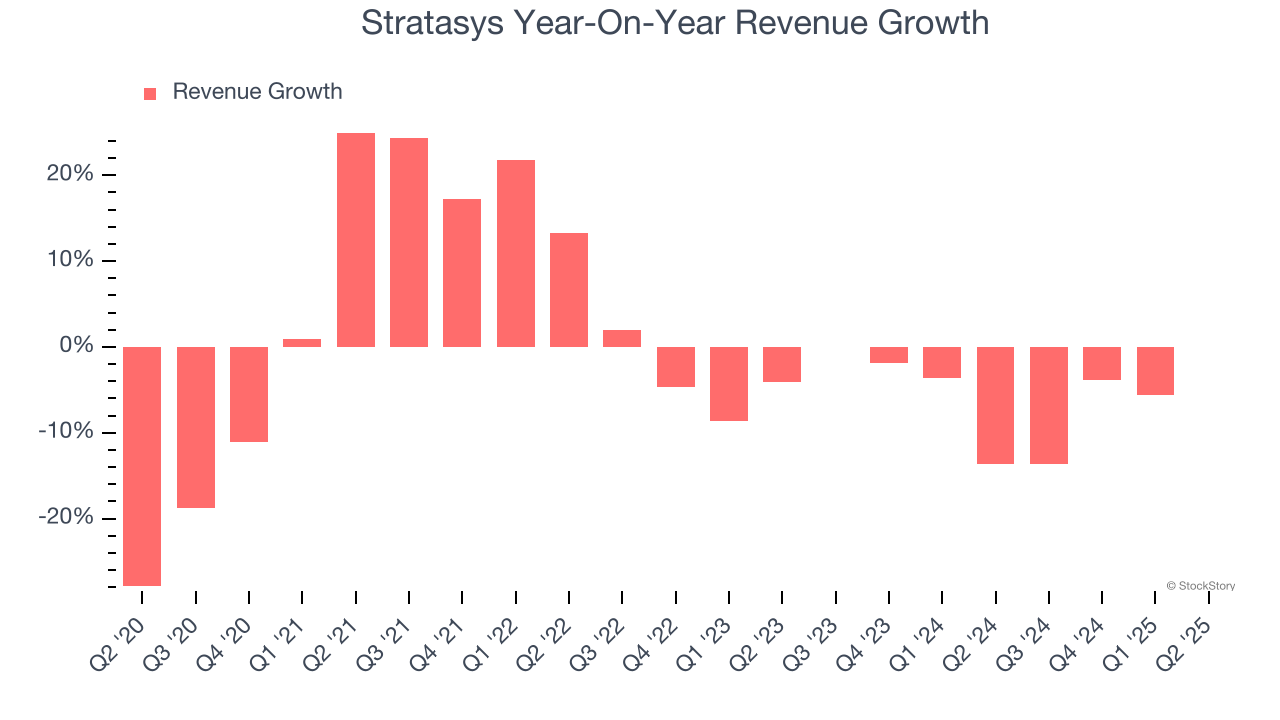

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Stratasys struggled to consistently increase demand as its $564.5 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Stratasys’s recent performance shows its demand remained suppressed as its revenue has declined by 5.4% annually over the last two years.

This quarter, Stratasys’s $138.1 million of revenue was flat year on year but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

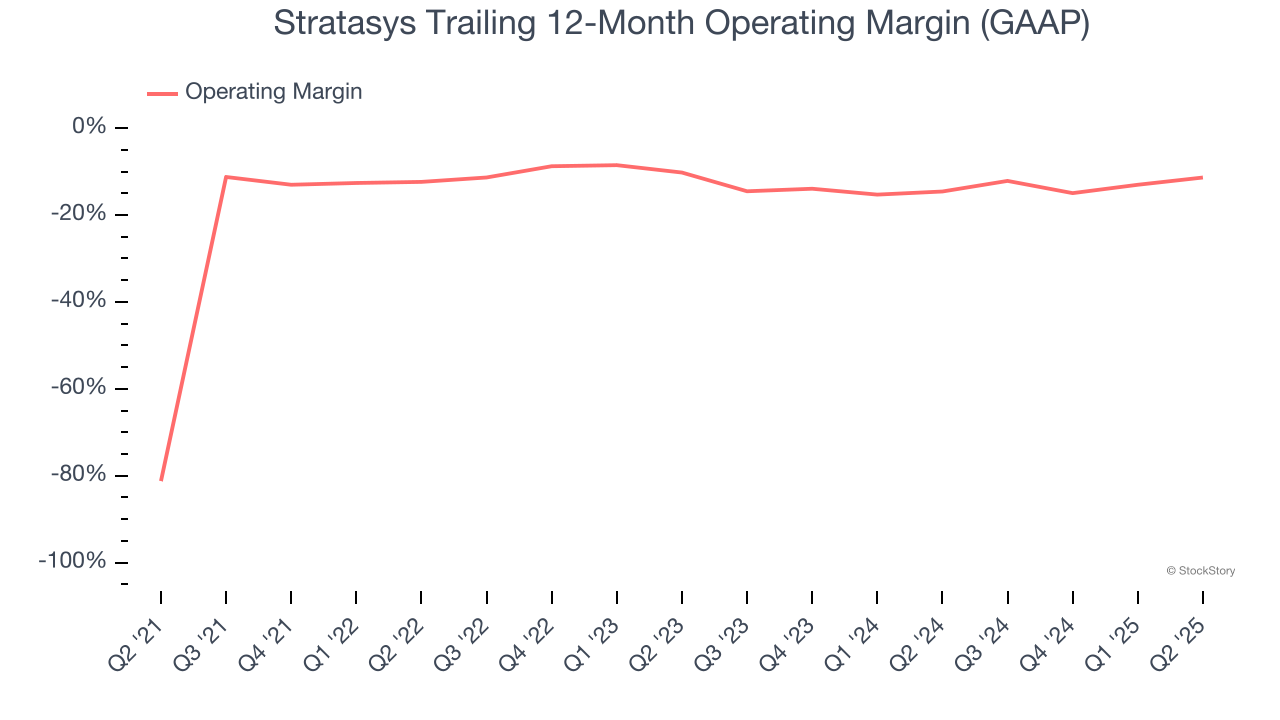

Stratasys’s high expenses have contributed to an average operating margin of negative 24.8% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Stratasys’s operating margin rose by 69.8 percentage points over the last five years. Still, it will take much more for the company to reach long-term profitability.

In Q2, Stratasys generated a negative 12% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

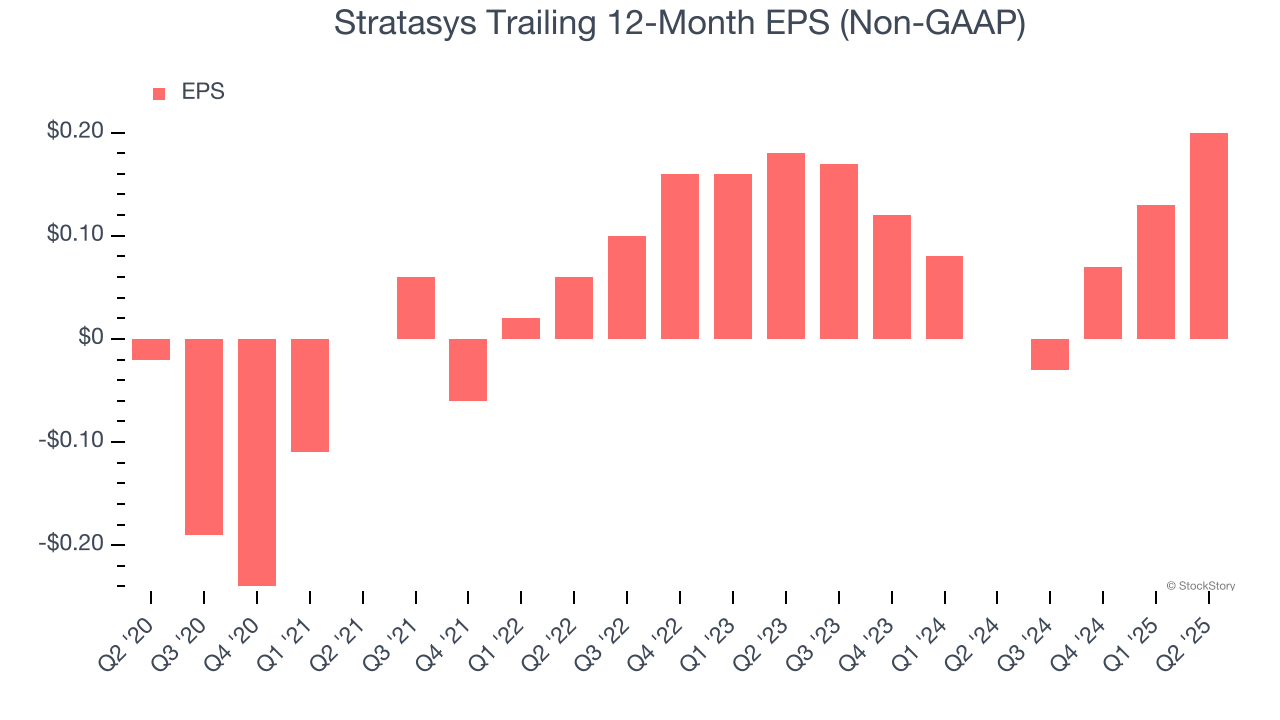

Stratasys’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Stratasys’s EPS grew at an unimpressive 5.4% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 5.4% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

We can take a deeper look into Stratasys’s earnings to better understand the drivers of its performance. Stratasys’s operating margin has expanded by 9 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, Stratasys reported adjusted EPS of $0.03, up from negative $0.04 in the same quarter last year. This print beat analysts’ estimates by 9.1%. Over the next 12 months, Wall Street expects Stratasys to perform poorly. Analysts forecast its full-year EPS of $0.20 will hit $0.37.

Key Takeaways from Stratasys’s Q2 Results

It was encouraging to see Stratasys meet analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 10.2% to $10.22 immediately after reporting.

The latest quarter from Stratasys’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.