Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

NZD/USD trades around 0.6000 on Wednesday at the time of writing, down 0.90% on the day, as investors digest mixed New Zealand labor market data and an uncertain global macroeconomic environment.

Via Talk Markets · February 4, 2026

All eyes are on Amazon Web Services as the tech behemoth warms up to report its fourth-quarter earnings on February 5th.

Via Talk Markets · February 4, 2026

Technical analysis on the stock chart for IBM.

Via Talk Markets · February 4, 2026

I talk about “the biggest economic trends of the past year and explain how rising tariffs are shaping prices, business decisions, and household budgets.”

Via Talk Markets · February 4, 2026

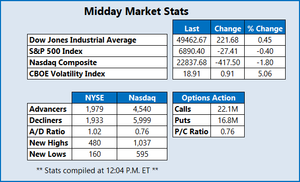

The S&P 500 is heading for its fifth loss in the last six sessions, as investors continue to rotate out of tech and weigh the latest labor market reading.

Via Talk Markets · February 4, 2026

LCNB has declared and paid variable quarterly dividends since March 2000. The December 2025 Q dividend of $0.22 suggests $0.88 annual dividend for the coming year.

Via Talk Markets · February 4, 2026

Markets open with the yen under pressure on the Japan election and stimulus risks.

Via Talk Markets · February 4, 2026

Oil maintains its bearish stance after the recent sell-off.

Via Talk Markets · February 4, 2026

Natural gas production has rebounded from recent freeze-offs but still lags nearly 4 BCF per day behind the record levels seen in December.

Via Talk Markets · February 4, 2026

Quantum industry CAGR is 36.9% through 2030, eyeing 5,000 operational units. Despite long-term growth, the sector continued its decline in January.

Via Talk Markets · February 4, 2026

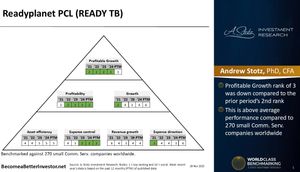

Readyplanet Public Company Limited provides an All-in-One Sales and Marketing Platform for businesses across Thailand.

Via Talk Markets · February 4, 2026

Novo Nordisk shares tumbled 18% after the company issued unexpectedly weak 2026 guidance, forecasting sales could decline as much as 13%.

Via Talk Markets · February 4, 2026

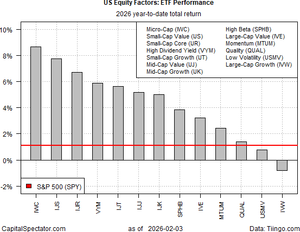

There have been multiple false dawns in recent years as large caps and growth stocks regained the performance crown after a burst of small-cap strength.

Via Talk Markets · February 4, 2026

We expect headline inflation to fall to 1.8% in April from 3.4% in December, a much faster pullback than the Bank of England is forecasting. It's another reason to think the Bank has more work to do. We expect rate cuts in March and June

Via Talk Markets · February 4, 2026

The Nasdaq 100 faced a

Via Talk Markets · February 4, 2026

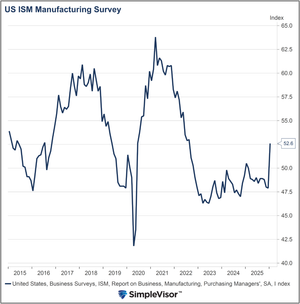

While the U.S. is not currently in a recession, the economy is struggling to avoid a downturn.

Via Talk Markets · February 3, 2026

Japan’s rising yields and currency volatility reflect an economic normalization.

Via Talk Markets · February 4, 2026

Crude oil prices are trending moderately lower this morning as traders weigh geopolitical tensions in the Middle East and a report of sharply lower US stockpiles reported by API overnight.

Via Talk Markets · February 4, 2026

Although the benchmark indices opened higher, they traded positively throughout the session and ultimately closed flat.

Via Talk Markets · February 4, 2026

Market jitters over the sustainability of AI demand and a broader rotation out of high-flying tech stocks have eclipsed Advanced Micro Devices' stellar fourth-quarter earnings.

Via Talk Markets · February 4, 2026

ADP's Employment report paints a poor picture for hiring (even if jobless claims paints a healthy picture for 'not firing'), adding just 22k jobs (well below the 45k expected).

Via Talk Markets · February 4, 2026

Earnings season risk is defined not by volatility, but by the

Via Talk Markets · February 3, 2026

The EUR/USD turned lower after starting the session on the front-foot.

Via Talk Markets · February 4, 2026

With artificial intelligence dominating investors’ thoughts, there is a constant search for investment ideas to profit from the AI boom.

Via Talk Markets · February 4, 2026

The major currency pair is engaged in recovery attempts. On Wednesday, EUR/USD strengthened to 1.1822.

Via Talk Markets · February 4, 2026

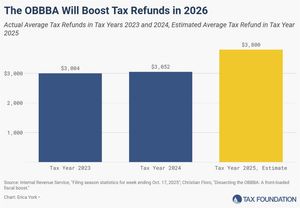

The Tax Foundation estimates refunds will be $748 more per household, on average, compared to last year.

Via Talk Markets · February 4, 2026

Bitcoin has shown resilience by holding the key $74,000 breakout pullback level from April 2025 and the $73,000 highs.

Via Talk Markets · February 4, 2026

Quarterly earnings reveal a mix of positive surprises and challenges, with Eli Lilly and AbbVie beating expectations and Uber facing hurdles.

Via Talk Markets · February 4, 2026

Semiconductor giant Nvidia has long been the darling of the artificial intelligence boom on Wall Street, but AMD’s rip-roaring start to 2026 shows investors that there could be a major market opportunity emerging.

Via Talk Markets · February 4, 2026

McDonald’s has broken March 2025 highs, aiming for 340 as Wave C unfolds, though the rally may be nearing its final stage.

Via Talk Markets · February 4, 2026

Gold, on Wednesday, returned above the key level of 5000 USD per ounce and has already approached 5067 USD.

Via Talk Markets · February 4, 2026

Chipotle reported another disappointing quarter after the close on Tuesday with -2.5% comps. For the first time ever, full year comps were negative at -1.7%.

Via Talk Markets · February 4, 2026

Sunday’s election is around the corner and polls show Prime Minister Takaichi leading the LDP to a strong showing, where it may recapture an outright majority.

Via Talk Markets · February 4, 2026

QE normalized huge bank reserves, so rapid QT risks liquidity stress, and the author argues policy should steer rates, not the balance sheet.

Via Talk Markets · February 4, 2026

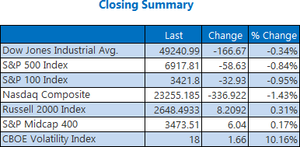

Markets moved lower yesterday, with major indices falling.

Via Talk Markets · February 4, 2026

Don't expect Kevin Warsh, or anyone else, to have any material effect on nature of the Federal Reserve or its mission.

Via Talk Markets · February 4, 2026

The first capital markets’ month of 2026 is now complete but the proposed appointment of the new Fed Chair changed a lot of the monthly returns significantly in just one day of trading.

Via Talk Markets · February 4, 2026

FTSE 100 reaches a record high, boosted by oil majors and miners.

Via Talk Markets · February 4, 2026

Software stocks across Asia, from India to Japan, took a hit as concerns mounted over how advancements in artificial intelligence could disrupt traditional business models, echoing the declines seen in their U.S. counterparts.

Via Talk Markets · February 4, 2026

The Pound Sterling rises against its peers on expectations that the BoE will hold interest rates steady on Thursday.

Via Talk Markets · February 4, 2026

The FTSE 100 is enjoying a strong start to the trading day, pushing into fresh record highs despite tech concerns that took the Nasdaq sharply lower in the US session yesterday.

Via Talk Markets · February 4, 2026

The initial estimate of the U.S. median household income for December 2025 is $86,820.

Via Talk Markets · February 4, 2026

The S&P 500 continues to see the 7,000 level as a major ceiling in the market, as we are waiting to see whether we can get a daily close above that level.

Via Talk Markets · February 4, 2026

In early February, Bitcoin declined to $72,800, reaching its lowest level since November 2024 amid an increase in forced liquidations of leveraged positions and accelerating capital outflows.

Via Talk Markets · February 4, 2026

Our view for this week remains that data has the most potential to steer USD crosses, and today’s busy US calendar offers a couple of opportunities.

Via Talk Markets · February 4, 2026

The current year, 2026, is a so-called midterm election year. For stocks, it is the weakest year in the four-year cycle.

Via Talk Markets · February 4, 2026

Over the last couple of weeks, we have shared evidence that supports the reflationary narrative and some that defies it.

Via Talk Markets · February 4, 2026

Indian share markets are trading marginally higher, with the Sensex trading 90 points higher, and the Nifty is trading 52 points higher.

Via Talk Markets · February 4, 2026

The EUR/USD exchange rate remained under pressure on Wednesday morning as traders waited for the upcoming European inflation data and ECB interest rate decision.

Via Talk Markets · February 4, 2026

Spreads between 10Y Italian and German bonds are at the tightest since 2008, helped by benign carry conditions. But we may hit a limit, as Italy still faces high debt levels.

Via Talk Markets · February 4, 2026

Spiking nearly +7% in Tuesday’s trading session, Palantir Technologies stock made headlines after delivering a blowout Q4 report yesterday evening.

Via Talk Markets · February 4, 2026

The USD/CAD pair turns lower for the second straight day and trades below mid-1.3600s through the early European session on Wednesday, though the downtick lacks bearish conviction amid mixed cues

Via Talk Markets · February 4, 2026

We'll review a few ratio charts that compare the gold price to various measures of housing in the US. Despite the housing devastation during the Global Financial Crisis, the old axiom that you can never go wrong buying a house persists.

Via Talk Markets · February 4, 2026

The Australian Dollar (AUD) advances against the US Dollar (USD) on Wednesday after registering over 1% gains in the previous session.

Via Talk Markets · February 4, 2026

The Indian Rupee is trading firmly against the US Dollar near 90.47, buoyed by a landmark trade deal announced by President Trump. The agreement, which caps reciprocal tariffs at 18%, has significantly boosted investor sentiment...

Via Talk Markets · February 4, 2026

Gold climbs above $5,000 as data delays, Fed uncertainty, and Middle East tensions drive safe-haven demand. Hawkish policy signals and geopolitical risks provide a strong backdrop for gold’s continued bullish momentum.

Via Talk Markets · February 4, 2026

Market indexes caved mid-afternoon on a combination rotation out of high-growth tech (of which AI stocks looked to be riding up again before getting slapped down Friday) and a tenuous feel regarding what’s around the corner for the economy.

Via Talk Markets · February 3, 2026

In this video, I break down the technical implications of today’s move, go over the key levels each ETF is bouncing from, and what it means for traders heading into the next few sessions.

Via Talk Markets · February 3, 2026

You don’t have to buy tech stocks to see great returns. Lesser-discussed companies have built consistent, dependable growth by doing the ‘simple’ things exceptionally well.

Via Talk Markets · February 3, 2026

Oil prices received a boost as tensions between the US and Iran resurface. For now, though, the latest escalation isn’t derailing planned talks

Via Talk Markets · February 3, 2026

Wednesday's market anticipates massive earnings from Alphabet and Amazon, alongside a volatility

Via Talk Markets · February 3, 2026

In this video, Ira Epstein discusses the unexpected downturn in the financial markets that occurred on February 3, 2026, triggered by Anthropic's announcement of a new legal software module that disrupted tech stocks.

Via Talk Markets · February 3, 2026

Stocks fell sharply, even though the S&P 500 finished the day down just 85 basis points. Technology and software stocks were hit the hardest, pushing the Nasdaq 100 down more than 1.5% and dragging the XLK ETF lower by over 2%.

Via Talk Markets · February 3, 2026

Gold is staging a strong recovery toward $5,000, while Bitcoin remains under pressure after a significant breakdown. The divergence highlights a shift in speculative flows as markets react to new Federal Reserve leadership and policy shifts.

Via Talk Markets · February 3, 2026

Gold price (XAU/USD) trades in positive territory near $4,985 during the early Asian session on Wednesday.

Via Talk Markets · February 3, 2026

The retest strategy is built on patience. Instead of chasing the surge, you let the breakout happen and allow the excitement to cool off. Then you wait for price to pull back to the level it just broke.

Via Talk Markets · February 3, 2026

The Pound Sterling traded in a narrow range against the US Dollar on Tuesday, edging modestly higher to near 1.3700 as markets adopted a cautious stance ahead of the BoE first policy decision of 2026.

Via Talk Markets · February 3, 2026

The recent market rotation toward small caps and value has also extended toward sectors, with Technology, which was one of the top-performing sectors of 2025, turning from a leader into a laggard in January.

Via Talk Markets · February 3, 2026

Walmart has had an amazing run so far during the 2020s, with its market cap rising from a little more than $300 billion in early 2020 to more than $1 trillion today.

Via Talk Markets · February 3, 2026

Despite strength in defensive sectors and select earnings winners, a deepening selloff in enterprise software stocks and a sharp decline in PayPal Holdings Inc. weighed heavily on sentiment.

Via Talk Markets · February 3, 2026

Tesla Inc. Q4 earnings, released on Jan. 28, were strong, but its near-term put options still have high yields.

Via Talk Markets · February 3, 2026

When investors become complacent, it usually means that the good times are about to come to an end. This is the situation we are in today.

Via Talk Markets · February 3, 2026

Ethereum price trades near $2,350 as whale selling caps rallies while oversold RSI signals hint at short-term volatility and support tests.

Via Talk Markets · February 3, 2026

In a sharp reversal, the Dow pulled back from record highs on Tuesday to settle more than 150 points lower. The S&P 500 finished firmly in the red as well, while the Nasdaq dropped 336 points as investors rotated out of tech.

Via Talk Markets · February 3, 2026